Financial Apps Reviewed to Master Your Money

In an economic landscape that grows increasingly complex, managing personal and household finances has evolved from a tedious chore into a critical life skill. From tracking daily expenses to navigating investments, paying bills, and planning for retirement, the sheer volume of financial decisions can be overwhelming. Fortunately, the digital age has ushered in a powerful solution: financial management apps. These aren’t just mere digital calculators; they are sophisticated, intuitive, and often AI-powered tools that fundamentally transform how we interact with our money, offering unprecedented clarity, control, and peace of mind. The widespread adoption of these applications marks a true boom, empowering individuals to make informed decisions and achieve their financial aspirations with remarkable efficiency.

This comprehensive article delves deep into the burgeoning world of financial management apps, dissecting their core functionalities, illustrating their transformative impact on financial well-being, and providing a detailed review of key categories. We will explore how artificial intelligence (AI), robust security measures, and seamless integration are converging to create a future where managing money is not just easier but genuinely insightful and proactive. Our aim is to provide a comprehensive roadmap for anyone seeking to leverage these indispensable digital instruments to gain mastery over their financial destiny, whether they are just starting their financial journey or are seasoned investors.

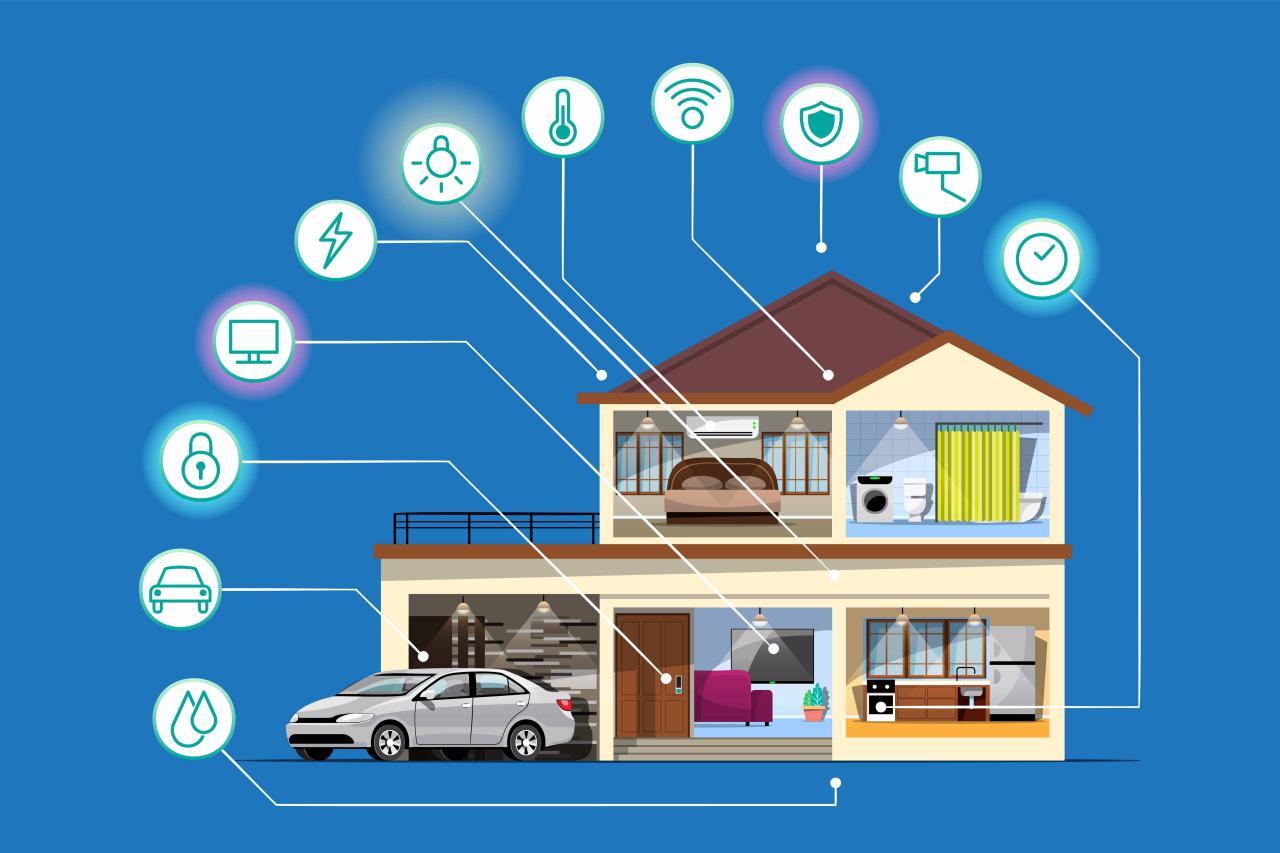

The Digital Wallet Revolution

For generations, personal finance management was a manual affair: ledgers, physical receipts, bank statements, and perhaps a trusty spreadsheet. While effective for their time, these methods were prone to human error, time-consuming, and lacked real-time insights. The advent of the internet brought online banking, but it was the smartphone and the subsequent explosion of mobile applications that truly democratized and revolutionized financial management.

Today, financial apps are game-changers due to:

- Unprecedented Accessibility: Your bank, budget, and investment portfolio are literally in your pocket, available 24/7 from anywhere with an internet connection.

- Real-time Data: Transactions are often categorized and updated instantly, providing an up-to-the-minute snapshot of your financial health.

- Automation: Many apps automate tedious tasks like transaction categorization, bill reminders, and savings transfers, reducing manual effort and potential oversight.

- Personalization: Leveraging AI, these apps can learn spending habits, suggest budgets, offer tailored investment advice, and even predict future cash flow.

- Enhanced Security: With features like multi-factor authentication, biometric logins, and robust encryption, financial apps often provide higher levels of security than traditional methods.

- Psychological Empowerment: Seeing your financial data clearly, understanding where your money goes, and tracking progress towards goals can significantly reduce financial stress and foster a sense of control.

This confluence of convenience, intelligence, and security has transformed financial apps from niche tools into indispensable companions for anyone serious about managing their money effectively.

Key Categories of Management Apps

The ecosystem of financial management apps is vast and specialized, catering to diverse needs, from daily spending tracking to long-term wealth building. Understanding these categories is the first step toward building your personalized financial toolkit.

A. Budgeting and Expense Tracking Apps

These are the foundational tools for understanding where your money goes and setting spending limits to achieve financial goals.

- Purpose: To categorize spending, monitor income, create budgets, and track progress towards savings goals. They help users identify spending leaks and build healthy financial habits.

- Key Features:

- Automatic Transaction Categorization: AI-powered algorithms often auto-categorize bank and credit card transactions, saving significant manual effort.

- Custom Budget Categories: Allows users to create specific spending limits for various categories (e.g., groceries, entertainment, utilities).

- Spending Alerts: Notifies users when they are approaching or exceeding budget limits.

- Visual Dashboards and Reports: Provides clear, graphical summaries of spending patterns, income, and budget adherence.

- Goal Tracking: Helps users set and monitor progress towards financial goals like saving for a down payment, a vacation, or paying off debt.

- Net Worth Tracking: Aggregates all accounts (bank, investments, debts) to show overall financial health.

- Examples:

- Mint (Intuit): One of the most popular free budgeting apps, offering comprehensive aggregation of bank accounts, credit cards, investments, and loans. Provides budget tracking, bill reminders, and credit score monitoring.

- YNAB (You Need A Budget): A highly regarded paid app known for its “Zero-Based Budgeting” philosophy, where every dollar is assigned a job. It focuses on intentional spending and breaking the paycheck-to-paycheck cycle.

- PocketGuard: Designed to help users see how much “spendable” money they have after accounting for bills, savings goals, and budgets. It simplifies budgeting for clarity.

- EveryDollar: Focuses on the “baby steps” debt payoff plan from Dave Ramsey, emphasizing cash flow management and intentional spending for debt elimination.

- Rocket Money (formerly Truebill): Excels at finding and canceling unwanted subscriptions, negotiating bills, and offering insights into recurring expenses to save money.

B. Investment and Trading Apps

These apps have democratized investing, allowing individuals to manage portfolios, research opportunities, and execute trades directly from their phones.

- Purpose: To facilitate buying and selling of financial instruments (stocks, ETFs, mutual funds, cryptocurrencies), manage investment portfolios, and access market data.

- Key Features:

- Real-time Market Data: Live quotes, charts, and news to inform trading decisions.

- Research Tools: Access to analyst reports, company fundamentals, and market trends.

- Low/Zero Commission Trading: Many platforms offer commission-free trading for stocks and ETFs.

- Fractional Shares: Allows users to invest in small portions of expensive stocks, making investing more accessible.

- Educational Content: Tutorials, articles, and webinars to help new investors learn the ropes.

- Portfolio Performance Tracking: Visual representation of investment gains/losses and overall portfolio health.

- Automated Investing (Robo-Advisors): Some apps offer automated portfolio management based on risk tolerance and financial goals.

- Examples:

- Robinhood: Known for pioneering commission-free stock trading and a user-friendly interface, attracting a new generation of investors. It also offers crypto trading.

- Charles Schwab Mobile/Fidelity: Mobile apps from established brokerage firms offering robust trading platforms, extensive research tools, and a wide range of investment products (stocks, bonds, mutual funds, ETFs).

- eToro: Popular for social trading, allowing users to copy the trades of successful investors, alongside traditional trading of stocks, crypto, and commodities.

- Binance/Coinbase: Leading cryptocurrency exchanges with mobile apps for buying, selling, and managing a wide array of digital assets.

C. Banking and Payment Apps

These apps bring core banking functions and digital payment capabilities to your fingertips, enhancing convenience and security.

- Purpose: To perform essential banking tasks (check balances, transfer money, pay bills) and facilitate digital transactions (peer-to-peer payments, in-store payments).

- Key Features:

- Mobile Check Deposit: Deposit checks by simply taking a photo.

- Bill Pay: Schedule and manage bill payments directly from the app.

- Account Balances and Transaction History: Real-time access to all account activity.

- Peer-to-Peer (P2P) Payments: Send and receive money instantly from friends and family (e.g., Zelle, Venmo).

- Card Management: Lock/unlock cards, set spending limits, and report lost/stolen cards.

- International Transfers: Services like Wise (formerly TransferWise) offer competitive exchange rates for international money transfers directly from the app.

- Examples:

- Major Bank Apps (e.g., Chase Mobile, Bank of America, HSBC, BCA Mobile in Indonesia): Offer comprehensive access to checking, savings, credit cards, and loan accounts, with robust security features.

- Wise (formerly TransferWise): Excels at international money transfers with transparent fees and real exchange rates.

- Revolut: A digital-only bank offering multi-currency accounts, international transfers, budgeting tools, and even cryptocurrency trading.

- PayPal/Venmo: Dominant P2P payment platforms, widely used for splitting bills, sending money to friends, and online purchases.

- Google Pay/Apple Pay: Enable secure contactless payments in stores and in apps, linking to credit/debit cards.

D. Debt Management and Credit Score Apps

These apps provide tools and strategies to help users understand, manage, and reduce debt, while also monitoring and improving their credit health.

- Purpose: To provide visibility into debt obligations, offer strategies for debt reduction, and help users track and improve their credit scores.

- Key Features:

- Credit Score Tracking: Regular updates on credit scores (e.g., FICO, VantageScore) and explanations of factors influencing them.

- Credit Report Monitoring: Alerts for changes or suspicious activity on credit reports to detect potential fraud.

- Debt Payoff Calculators: Tools to compare debt snowball vs. debt avalanche methods, illustrating payoff timelines and interest savings.

- Personalized Advice: Recommendations for improving credit scores or managing specific types of debt.

- Examples:

- Credit Karma: Offers free credit scores and reports (VantageScore), along with monitoring services and personalized recommendations for financial products.

- Experian/FICO: Direct access to credit reports and scores from major credit bureaus, with monitoring and educational resources.

- Debt Payoff Planner/Undebt.it: Dedicated apps for creating and tracking debt payoff plans, helping users stay motivated and organized.

E. Financial Planning and Wealth Management Apps

These apps cater to users seeking a more holistic view of their finances, helping them plan for long-term goals like retirement, college savings, or significant purchases.

- Purpose: To aggregate all financial accounts, calculate net worth, set and track long-term financial goals, and often provide tools for retirement planning and investment strategy.

- Key Features:

- Net Worth Tracking: Comprehensive aggregation of all assets (bank accounts, investments, real estate) and liabilities (mortgages, loans) to provide a single net worth figure.

- Retirement Calculators: Tools to project retirement savings, analyze withdrawal strategies, and assess readiness for retirement.

- Goal-Based Planning: Helps users define specific financial goals and creates pathways to achieve them.

- Integration with Human Advisors: Some platforms allow users to connect with certified financial planners for personalized guidance.

- Tax Optimization Tools: Features that help users understand the tax implications of their investments and spending.

- Examples:

- Empower Personal Dashboard (formerly Personal Capital): A powerful free tool for aggregating all financial accounts, tracking net worth, analyzing investments, and planning for retirement.

- Fidelity Full View: Similar aggregation and planning tools offered by Fidelity, often for their investment clients.

- Vanguard: Provides robust tools for managing Vanguard investment accounts, with a focus on low-cost index funds and ETFs, along with planning calculators.

AI, Security, and Connectivity

The remarkable capabilities of modern financial management apps are powered by sophisticated underlying technologies, particularly Artificial Intelligence, robust security frameworks, and seamless connectivity.

A. Artificial Intelligence (AI) and Machine Learning (ML)

AI is the intelligent backbone that transforms raw data into actionable insights and automates complex tasks.

- Automated Categorization: ML algorithms analyze transaction descriptions and amounts to automatically categorize spending (e.g., identifying “Starbucks” as “Coffee & Cafes”). This significantly reduces manual effort and improves data accuracy.

- Predictive Insights: AI can forecast future cash flow based on historical spending, recurring bills, and projected income, helping users avoid potential overdrafts or identify periods for saving. It can also predict potential financial risks or opportunities.

- Personalized Advice: AI acts as a virtual financial advisor, offering tailored recommendations for budgeting, debt payoff strategies, or investment allocations based on a user’s unique financial situation, goals, and risk tolerance.

- Fraud Detection: ML models analyze transaction patterns in real-time, identifying anomalous activities that deviate from a user’s typical spending, flagging potential fraudulent transactions before they cause significant damage.

- Chatbots and Natural Language Processing (NLP): Many apps incorporate AI-powered chatbots that can understand natural language queries (e.g., “How much did I spend on groceries last month?”), provide instant answers, and offer support, reducing the need for human customer service for routine questions.

B. Robust Security Frameworks

Given the sensitive nature of financial data, these apps employ multiple layers of advanced security to protect user information.

- Encryption: All data, both at rest (stored on servers) and in transit (sent over networks), is heavily encrypted using industry-standard protocols (e.g., AES-256, TLS 1.2/1.3). This makes data unreadable to unauthorized parties.

- Multi-Factor Authentication (MFA): Essential for an added layer of security. Beyond just a password, users must verify their identity using a second factor (e.g., a code from an authenticator app, an SMS code, or a biometric scan).

- Biometric Authentication: Features like Face ID and fingerprint scanning provide a convenient yet highly secure way to log in to apps, leveraging unique biological characteristics.

- Regular Audits and Compliance: Reputable financial apps undergo regular third-party security audits and adhere to strict financial industry regulations and data protection laws (e.g., GDPR, CCPA, local banking regulations).

- Fraud Monitoring and Alerts: Real-time systems constantly monitor account activity for suspicious transactions or login attempts, often sending immediate alerts to users.

- Data Anonymization and Aggregation: For analytical purposes, data is often anonymized and aggregated, removing personally identifiable information to protect privacy while still allowing for valuable insights.

C. Open Banking and APIs

The rise of Open Banking initiatives and the widespread use of Application Programming Interfaces (APIs) are fundamental to the functionality of modern financial apps.

- Secure Account Connection: APIs allow financial apps to securely connect to users’ bank accounts, credit cards, and investment accounts, pulling transaction data and balances with user permission, without storing actual login credentials.

- Data Aggregation: This connectivity enables apps to aggregate financial data from multiple institutions into a single, comprehensive view, providing a holistic snapshot of a user’s financial life.

- Driving Innovation: Open APIs foster innovation by allowing third-party developers to build new financial products and services on top of existing banking infrastructure, leading to a richer app ecosystem.

D. Cloud Computing Infrastructure

Cloud platforms provide the scalable, secure, and accessible infrastructure upon which financial apps are built.

- Scalability: Cloud infrastructure can instantly scale to handle millions of users and billions of transactions, ensuring apps remain fast and responsive even during peak usage.

- Accessibility and Real-time Sync: Data is stored in the cloud, allowing users to access their financial information and update their records from any device, anywhere, with real-time synchronization.

- Secure Data Storage: Cloud providers invest heavily in physical and cyber security for their data centers, often surpassing the security capabilities of individual on-premise solutions.

- Disaster Recovery: Cloud platforms provide robust data redundancy and disaster recovery capabilities, minimizing the risk of data loss due to unforeseen events.

Transformative Impact for Your Financial Life

The widespread adoption of financial management apps is having a profound and positive impact on how individuals approach and achieve financial well-being.

A. Enhanced Financial Literacy and Empowerment

- Clarity and Visibility: By visually presenting income, expenses, and savings, apps demystify personal finance, making it easier for users to understand their financial position.

- Behavioral Nudging: Many apps use alerts, progress trackers, and gamification to encourage positive financial habits and discourage impulsive spending.

- Knowledge Acquisition: Educational content within apps (articles, videos, explainers) helps users learn about budgeting, investing, debt, and credit.

B. Greater Financial Control

- Proactive Management: Users move from reactively checking bank balances to proactively managing their money, setting goals, and making informed decisions.

- Debt Reduction: Apps provide clear pathways and motivation to tackle debt efficiently, often illustrating how small changes can lead to significant savings on interest.

- Savings Acceleration: By automating savings and highlighting unnecessary spending, apps help users reach their savings goals faster.

C. Reduced Financial Stress and Anxiety

- Peace of Mind: Knowing exactly where your money stands and having a plan reduces anxiety about finances.

- Fewer Surprises: Bill reminders, spending alerts, and cash flow forecasts help users avoid unexpected financial shortfalls.

D. Achievement of Financial Goals

- Goal-Oriented Planning: Apps help break down large financial goals (e.g., buying a house, retirement) into manageable steps, making them seem achievable.

- Automated Progress: Automated savings transfers and investment contributions ensure consistent progress towards long-term objectives.

E. Convenience and Accessibility

- Anytime, Anywhere Access: Manage your finances on your commute, during breaks, or from the comfort of your home.

- Simplified Transactions: Paying bills, transferring money, and even depositing checks becomes instant and effortless.

- Financial Inclusion: Mobile-first banking and payment apps provide financial services to individuals in regions with limited access to traditional banking infrastructure.

F. Democratization of Financial Services

- Investing for Everyone: Low-cost or commission-free trading platforms have opened up investing to a broader audience, not just the wealthy.

- Personalized Advice: AI-powered robo-advisors and virtual assistants make personalized financial advice accessible to those who might not afford traditional financial planners.

Challenges and Considerations for Users

While the benefits are compelling, adopting financial management apps comes with important considerations and potential challenges that users should be aware of.

A. Data Security and Privacy Concerns

- Trust in Third Parties: Users must place immense trust in app providers to securely handle their most sensitive financial data.

- Risk of Data Breaches: Despite robust security, no system is entirely impenetrable. Users should be aware of the potential for data breaches and choose apps with strong security track records.

- Data Sharing Practices: Understand how apps might share your aggregated, anonymized data for research or marketing purposes, even if personal identifiers are removed.

- Phishing and Scams: Users must remain vigilant against phishing attempts that try to trick them into revealing app login credentials.

B. Over-Reliance and False Sense of Security

- Still Requires Human Oversight: While apps automate much, they are tools, not ultimate decision-makers. Users still need to review categories, confirm transactions, and understand the logic behind advice.

- “Set It and Forget It” Pitfall: An automated budget still requires occasional adjustments and attention to remain effective.

- Gamification Risks: While motivating, gamified elements could sometimes encourage over-investing or unnecessary spending if not used wisely.

C. Information Overload and Complexity

- Too Many Features: Some apps offer a dizzying array of features that can overwhelm users, making it difficult to find core functionalities.

- Initial Setup: Connecting all bank accounts and credit cards can sometimes be a tedious initial process, especially if institutions have strict security protocols.

- Categorization Accuracy: While AI auto-categorizes, manual review is often needed, and incorrect categorizations can skew budget insights.

D. Subscription Costs vs. Free Models

- Freemium Models: Many apps offer a basic free version with limited features, pushing users towards paid subscriptions for advanced functionalities.

- Hidden Fees: Users should carefully review terms for any potential transaction fees, withdrawal fees, or other hidden charges, especially with investing or international transfer apps.

- Value for Money: Evaluate whether the subscription cost truly justifies the benefits and features received for your specific needs.

E. Integration Issues and Compatibility

- Limited Bank Connectivity: Not all small or regional banks may be supported by every financial app’s aggregation service.

- Data Sync Delays: Sometimes, transaction data may not sync instantly, leading to temporary discrepancies between the app and the bank’s actual balance.

- Third-Party App Reliance: Many apps rely on third-party aggregators (like Plaid) which introduces another layer of security and data handling to consider.

Conclusion

The profound impact of financial management apps is undeniable, transforming what was once a daunting task into an accessible, insightful, and often engaging journey. These digital tools, fueled by cutting-edge AI, robust security, and seamless connectivity, empower individuals to gain unprecedented clarity over their money, set ambitious goals, and ultimately, secure their financial future. From meticulously tracking every expense and paying off debt strategically to intelligently investing for long-term wealth, the power to master one’s money is now truly at one’s fingertips.

While navigating the landscape requires vigilance regarding security, an understanding of potential costs, and the need for consistent engagement, the continuous innovation in this sector promises an even more personalized, intuitive, and seamlessly integrated financial experience. Embracing these essential digital instruments, understanding their capabilities, and integrating them mindfully into your daily life is not just a convenience; it is the pathway to building financial resilience, achieving your aspirations, and living a life of greater financial freedom and peace of mind. The future of your finances is being shaped by these apps.